Disruptive Models for Telecom Operators in a New Digital Ecosystem

Christian James Aguilar-Armenta, Federal Telecommunications Institute of Mexico, This email address is being protected from spambots. You need JavaScript enabled to view it.

IEEE Future Networks Tech Focus: Volume 2, Number 3, December 2018

Abstract

Because the new digital ecosystem implies the development of novel telecommunications services, both telecom operators and regulators are faced with new opportunities and challenges. It is thus necessary to understand the role that telecom operators will play in the value chain of new business models, their interactions with other stakeholders, as well as the potential regulatory impacts of all this. In this article we present an examination of some key innovative business models wherein operators are the main actors. Our data analysis leads us to conclusions about regulatory challenges and potential competition implications for 5G.

1. Introduction

In this article we examine how telecom operators (Telcos) and stakeholders are currently engaging in new business models fostered by the new digital ecosystem when providing services, so as to generate hypothesis about the competition impacts and regulatory implications that these might bring in years to come. We begin by presenting an analysis of the participation that Telcos have in current new business. Subsequently, we address the potential repercussions and challenges that these new business models represent for both operators and regulators.

2. New Digital Ecosystem

The new ecosystem has the potential to lure in both novel and extant participants of the digital world, increasing the participation of the latter with new services and innovative technologies in Telcos' value chain.

But, all in all, what makes this new ecosystem so attractive and promising? The most likely answer is the technologies that are essential for the development of 5G, which will bring different attributes compared to the current 4G networks, namely: massive MIMO, beam-forming, Software Defined Networking (SDN) and Network Function Virtualization (NFV). The last two in particular will allow the Network Slicing to meet specific needs with specific network attributes [1]. This capacity creates a number of possible services that we have not seen so far. These technologies, in combination with the massive deployment of small cells, will allow 5G networks to have the capacity to: 1) provide higher speed and broadband (xMBB); 2) support the massive connectivity of various devices (mMTC); and 3) provide connectivity with very low latency and with high level of reliability (uMTC) [1], the latter commonly known as URLLC.

This new digital ecosystem will allow the development not only of super connectivity services but it will also offer specific solutions across different sectors in both urban and rural areas. However, these opportunities will not only be presented to Telcos but to all the stakeholders involved in the ecosystem. It is right here where the new disruptive business models emerge and where the value chain will be modified due to the participation of more actors.

3. Methodology

A systematic review of a wide variety of sources was performed, aiming to pinpoint: 1) new business models for Telcos; 2) the competition implications; and 3) regulatory challenges. We focused on academic and telecom standardization bodies’ databases, Telcos’ official websites, informative, analytic or editorial texts published online by consulting agencies, as well as specialized news sites. Although the last three cannot be considered as scientific references, sometimes they were the only existing sources of information about newest business models. In order to narrow down our search to pertinent resources, we developed a boolean search combination of terms related to the new digital ecosystem (e.g. IoT, 5G, Big Data, AI, etc.), plus those pertaining to Telcos (e.g. network operators, communications service providers, etc.).

4. Results

So far, there is no launch of a large-scale 5G network in any country, there has only been pre-commercial testing of 5G services [2]. In spite of this, at present there are services of the new digital ecosystem that enable the development of new business models of which Telcos are the main providers.

We were able to identify 27 use cases in which operators are the main actors. It is important to note that the number of cases are not of primordial importance for this article. What is indeed substantive is the identification of new business models and, above all, the possibility to predict the potential competition and regulatory implications for the sector. Table 1, therefore, concentrates on only five representative use cases that are outside the universe of services that Telcos traditionally offer, in order to synthesize the most relevant information about these new business models. In the subsequent section, however, we expound on the competition and regulatory aspects that we consider require attention from the regulators, based on the analysis of the 27 use cases that we identified.

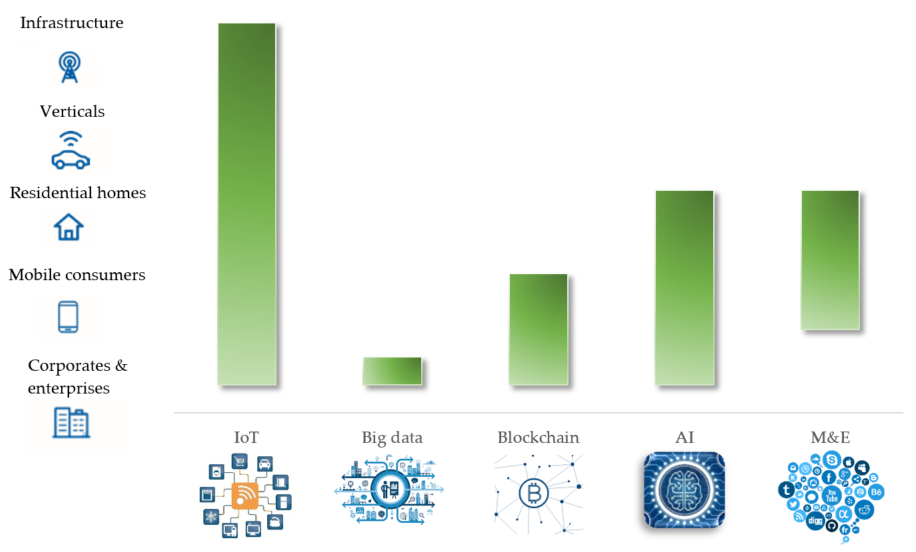

As a supplement to the results, Fig. 1 features a schematic of the 27 use cases that we identified, classified by groups, showing the sectors of greatest commercial interest for Telcos that they target [3]. This schematic is not a standard representation of the new business models that exist in the market today; it only shows the particular distribution of the use cases that we found.

Figure 1. Schematic representation of services by group and target sectors

Table 1. Selection of use cases

| Use cases | Service | Network Requirements | Business model |

|

IoT [4] |

Mobile network platform that provides connectivity, management and control for autonomous vehicles in South Korea. | Low latency; High reliability; High throughput; High availability; Connection density; Traffic volume density; Coverage (mobility); Security; Data analytics; AI. |

Marketing of the 5G self-driving technologies consisting in network capacity (28 GHz band), AI, sensors, and 3D HD maps by SK Telecom to provide connectivity, management and control of autonomous vehicles. SK Telecom in partnership with Nvidia and LG Electronics, as well as in collaboration with The Korean Transportation Safety Authority and the University of Seoul. |

| Big Data [5] | Telefonica’s Big Data service unit to provide an information analysis service to help its clients in decision-making and resource management processes. | Data analytics;

Cloud computing; |

Marketing of three Big Data business lines: 1) Business Insights: provides companies with anonymous and aggregated data collected by Telefonica’s networks; 2) Synergic Partners: provides analytical and consultancy data services; and 3) Big Data as a service: giving enterprises the means to make better use of their own data, using Telefonica’s cloud infrastructure. |

| Blockchain [6] | City Pass to pay multiple services such as bike sharing, tourist sites, libraries, etc. by means of a card or a mobile app that allows authentication and secure mapped direct transactions with the platform. | Low latency;

High availability; |

Marketing of the City Pass service by Deutsche Telekom to carry out direct, secure and decentralized digital transactions between the user and the platform. Open and independent system for the integration of more services. |

| AI [7] | Home device (speaker) based on voice recognition that works as a virtual assistant for smart home control services, music, weather and traffic information, e-commerce service and multimedia playback. | Cloud computing;

Data analytics; |

Marketing of the virtual assistance device by SK Telecom, with an open interface to incorporate other AI devices and services into the ecosystem. SK Telecom will also integrate other AI developers to strengthen the ecosystem. |

|

Media & Entertainment [8] |

Test of 5G commercial network in the Winter Olympic Games in South Korea to provide services such as: 1) 4K transmission and 360° vision; 2) VR; 3) massive connectivity of devices and control with Edge Computing; 4) high throughput; and 5) enhanced broadband. | High throughput;

High reliability; |

Marketing of 5G services by KT, Intel, Toyota, Samsung and Ericsson. In particular, Intel provides the FlexRAN platform and Edge Computing technology, as well as cloud computing and data center functions; Samsung and Ericsson, in direct collaboration with KT, provide the 5G network in the 28 GHz band. The network test paves the way for the operator to launch commercial 5G services. |

5. Regulatory Challenges and Potential Competition Implications

We seek to help regulators anticipate the needs to encourage investment by Telcos towards 5G success. In the following subsections we present a brief explanation of each of the aspects that we consider are of relevance to the authorities.

A. Regulatory Challenges

Spectrum. The new digital ecosystem requires spectrum classified into three general frequency ranges: <1 GHz, 1 - 6 GHz, and > 6GHz. The 600, 700, 800 and 900 MHz bands are important for the range below 1 GHz. The 3.4 - 4.2 GHz band is significant in the segment 1 - 6 GHz. Likewise, bands 1.4 and 2.5 GHz are important in this segment. The 26 and 28 GHz bands stand out among the frequencies above 6 GHz; however, there are others frequencies that are in the process of identification by the WRC-19 (i.e. 37- 43.5 GHz, 45.5 - 50.2 GHz, 66 - 76 GHz and 81 - 86 GHz).

It is also necessary to explore adequate models for assignment spectrum for both isolated areas (e.g. smart farming) and confined or delimited areas (e.g. smart factory) that require specific solutions. The use of unlicensed bands may not be sufficient for services that require greater security and reliability. We also consider it important to capitalize more from the secondary licenses of the spectrum, as well as from other spectrum sharing techniques at high frequencies that experience limited propagation and less interference.

Infrastructure. It is necessary to create adequate models for infrastructure sharing, mainly for indoor places in urban areas for small cell densification. Flexibility of new entrants who intend to market their infrastructure and spectrum could be another important factor.

Open architectures. In order to guarantee the interconnection and interoperability between networks, it is essential for regulators to be very attentive to the use of new technologies and to ensure both technological neutrality and the adoption of international standards among operators.

Quality of services. Quality standards will have to broaden their scope and not to be limited to throughput parameters. Several services would require clear quality standards, particularly those that require low latency, connection density, traffic volume density, high availability and reliability.

Service differentiation. In theory, Network Slicing will allow a Telco to provide various services with specific requirements through the same network without interfering the traffic and performance of the different services that are on the network. If so, regulators would have to establish clear rules to avoid violating the net neutrality, similar to the following: 1) the capacity of the network should be sufficient to provide specialized services in addition to any Internet Access Service (IAS) that is provided; 2) the specialized services are not used or offered as a replacement for the IAS; and 3) the specialized services should not diminish the availability or the quality of the IAS.

Ethical and legal regulation of AI systems. Security and privacy are the aspects that most concern people when using AI systems, particularly due to the lack of a clear ethical and legal scenario that limits the scope and responsibilities of these systems.

Delimitation of responsibilities. It is important to define the responsibilities of the participants in the value chain, as well as to be able to identify the responsible (e.g. AI systems).

Security, privacy and data protection. It is evident that digital data is the sine qua non of all digital services. Therefore, regulators should encourage the development of the new ecosystem while ensuring: 1) privacy or control over the dissemination of people‘s personal data; 2) the non-vulnerability of the data; and 3) protection through some type of security.

B. Competition implications

Association or vertical integration. The associations of Telcos with other stakeholders in the provision of a service turned out to be an option for most of the new business models that we found.

Possible entry barriers. The associations can generate entry barriers for other operators and suppliers of technology, equipment, platforms or applications.

Tariff differentiation per service. The lack of a clear tariff plan for new services that involve the connection of several devices could affect the balance between the cost-benefit that users acquired and the costs that the operators need to recover.

Possible distortion of neutrality to competition. It is essential that the participation of the Government does not generate distortions to the market because of its power over public property.

Possible barriers to access essential supplies. Big Data services use aggregated and anonymous data collected from Telcos’ network users as essential input. This could generate commercial disadvantages to other competitors if there is an incumbent providing these services.

6. Conclusions

The new digital ecosystem represents several significant changes in the creation, provision and commercialization of new telecommunications services. From our analysis of the new business models identified, we derive the following conclusions:

- The new business models are aimed at vertical industries, specific sectors and business niches that go beyond connectivity services;

- The new ecosystem represents business opportunities for all stakeholders of the digital world;

- The value chain can be modified upstream with the participation of new stakeholders that provide, for example, infrastructure for small cells, as well as downstream with the participation of intermedaries that offer services directly to the end user;

- In a very general way we consider that there are four possible participation scenarios for Telcos in the value chains: 1) they dominate the entire value chain and are responsible for providing both technology and services to end users; 2) they are the main actors of the value chain and are responsible for providing the service to end users; however, they require third-party specialists in the sector for the provision of technology and platforms; 3) they have the best technological network capabilities to support the specific requirements across different sectors, nonetheless they are not the ones who provide services to end users but intermediaries who know the sectors very well; and 4) they remain outside the value chain because technology developers, in collaboration with new specialists in the sector, have the ability to provide specific services to end users;

- The success of Telcos depends, among other things, on their ability to meet the specific requirements of users, the investment they make in their networks for the deployment of new capabilities, their strategy of participation in the value chain, and of their capacity to take advantage of all the wireless, fixed and satellite technologies that currently exist for the provision of mixed connectivity.

References

- A. Osseiran, J. F. Monserrat, and P. Marsch. “5G mobile and wireless communications technology”. Cambridge, UK: Cambridge University Press, 2016.

- D. Johnson, “5G Poised for Commercial Rollout by 2020”, IEEE Spectrum: Technology, Engineering, and Science News, 2018.

- K. Taga, R. Swinford, and G. Peres, “5G deployment models are crystallizing”, Arthur D Little, 2017.

- J. P. Tomás, “South Korea allows KT to test self-driving bus in Seoul”, Enterprise IoT Insights, 2018.

- J. P. Tomás, “Telefonica launches big data services unit”, Enterprise IoT Insights, 2016.

- C. Sentürk, and A. Ebeling, “City Pass – Blockchain”, Deutsche Telekom, 2018.

- J. P. Tomás, “SK Telecom unveils artificial intelligence service”, Enterprise IoT Insights, 2016.

- M. Dano. “KT’s millimeter wave 5G network transmitted 3,800 TB of data during Winter Olympics”, FierceWireless, 2018.

Christian James Aguilar A. received his Ph.D. degree in Electronic Engineering from the University of York, UK. He holds a BSc in Telecommunications Engineering from the National Autonomous University of Mexico (UNAM). He has more than five years of experience in the Telecom industry, public sector and research. Currently his is a researcher at the Federal Telecommunications Institute (IFT) of Mexico. Previously, he was the technical adviser of former Commissioner Adriana Labardini of IFT, a post he held for over three years. His latest research project revolves around disruptive business models for Telcos in the 5G ecosystem. He has published various scientific articles, among which stands one entitled: ‘Cantilever RF-MEMS for Monolithic Integration with Phased Array Antennas on a PCB’.

Christian James Aguilar A. received his Ph.D. degree in Electronic Engineering from the University of York, UK. He holds a BSc in Telecommunications Engineering from the National Autonomous University of Mexico (UNAM). He has more than five years of experience in the Telecom industry, public sector and research. Currently his is a researcher at the Federal Telecommunications Institute (IFT) of Mexico. Previously, he was the technical adviser of former Commissioner Adriana Labardini of IFT, a post he held for over three years. His latest research project revolves around disruptive business models for Telcos in the 5G ecosystem. He has published various scientific articles, among which stands one entitled: ‘Cantilever RF-MEMS for Monolithic Integration with Phased Array Antennas on a PCB’.

Editor:

Siming Zhang received the dual BEng degrees with the highest Hons. from the University of Liverpool (UK) and Xi’an JiaoTong and Liverpool University (XJTLU, China) respectively in 2011. She obtained her M.Sc with distinction and her Ph.D. degree from the University of Bristol (UK) in 2012 and 2016. She then joined China Mobile Research Institute and currently works on research areas ranging from Massive MIMO and mmWave, channel measurements and modeling, conductive testing and prototype development. She has been an active member of the IEEE Communications Society and IEEE Young Professionals. She serves as the Associate Managing Editor of the IEEE 5G Tech Focus. She is the co-lead on the PoC project in the NGMN Trial and Testing Initiative. She is the TPC for IEEE ISCC2017. She has received numerous awards for her outstanding achievements during her study and her career.

Siming Zhang received the dual BEng degrees with the highest Hons. from the University of Liverpool (UK) and Xi’an JiaoTong and Liverpool University (XJTLU, China) respectively in 2011. She obtained her M.Sc with distinction and her Ph.D. degree from the University of Bristol (UK) in 2012 and 2016. She then joined China Mobile Research Institute and currently works on research areas ranging from Massive MIMO and mmWave, channel measurements and modeling, conductive testing and prototype development. She has been an active member of the IEEE Communications Society and IEEE Young Professionals. She serves as the Associate Managing Editor of the IEEE 5G Tech Focus. She is the co-lead on the PoC project in the NGMN Trial and Testing Initiative. She is the TPC for IEEE ISCC2017. She has received numerous awards for her outstanding achievements during her study and her career.

Subscribe to Tech Focus

Join our IEEE Future Networks Technical Community and receive IEEE Future NetworksTech Focus delivered to your email.

Article Contributions Welcome

Submit Manuscript via Track Chair

Author guidelines can be found here.

Other Future Networks Publications

IEEE Future Networks Tech Focus Editorial Board

Rod Waterhouse, Editor-in-Chief

Mithun Mukherjee, Managing Editor

Imran Shafique Ansari

Anwer Al-Dulaimi

Stefano Buzzi

Yunlong Cai

Zhi Ning Chen

Panagiotis Demestichas

Ashutosh Dutta

Yang Hao

Gerry Hayes

Chih-Lin I

James Irvine

Meng Lu

Amine Maaref

Thas Nirmalathas

Sen Wang

Shugong Xu

Haijun Zhang

Glaucio Haroldo Silva de Carvalho